Wealth building is possible for You

even if you don't make 6 figures. Or, you make 6 figures but haven't been able to get ahead financially. You need a complete educational financial plan (includes investing) and a support group.

We've got you covered.

JOIN THE WAITING LIST

Wealth building is possible for YOU, even if you don't make 6 figures. Or, you make 6 figures but haven't been able to get ahead financially. You need a complete educational financial plan (includes investing) and a support group. We've got you covered.

Group Virtual Class Led by Dr. Kisha

Building Your $1 Million Portfolio Now!

Tired of feeling stuck and stressed about money?

This course will show you how to build a $1 million portfolio, pay off debt, and finally achieve financial freedom—starting today.

Save More

Build wealth.

Financial freedom is possible for you no matter what disaster or disruption you have been through!

This program begins with budgeting, teaches you everything about retirement accounts and then how to start investing to be free in 10 years or less!

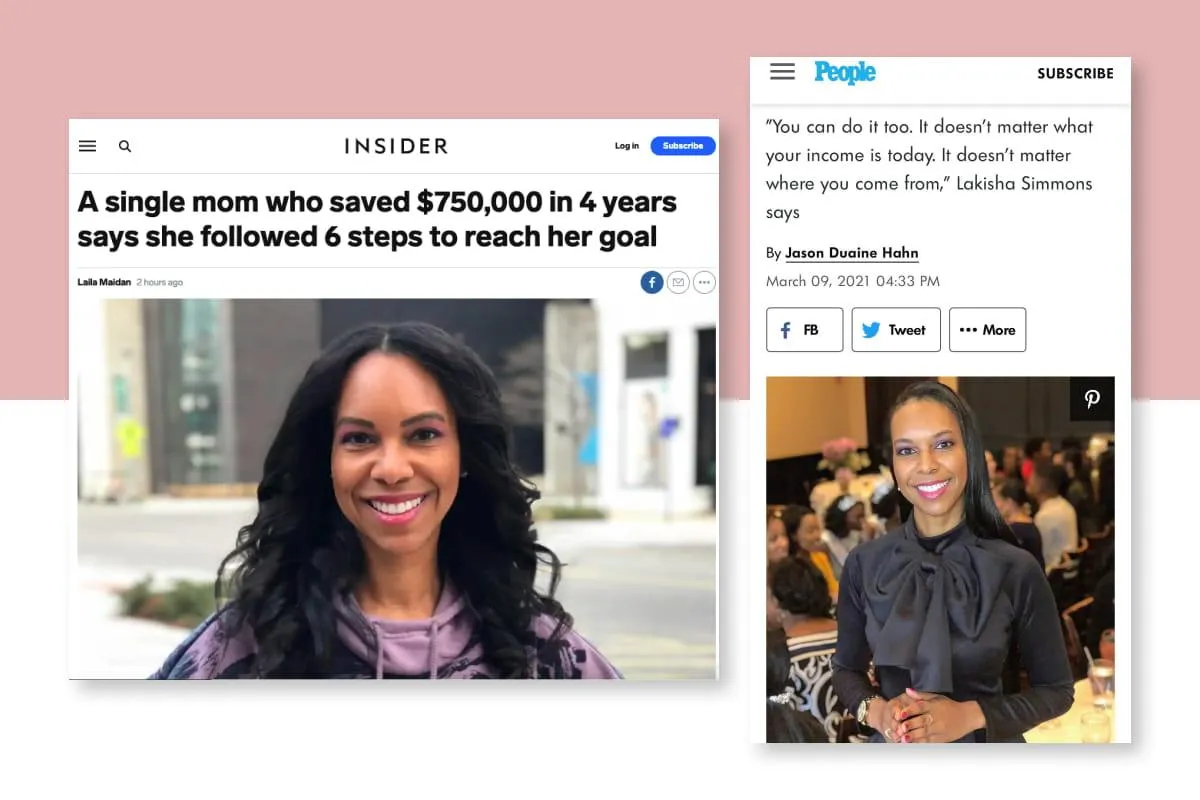

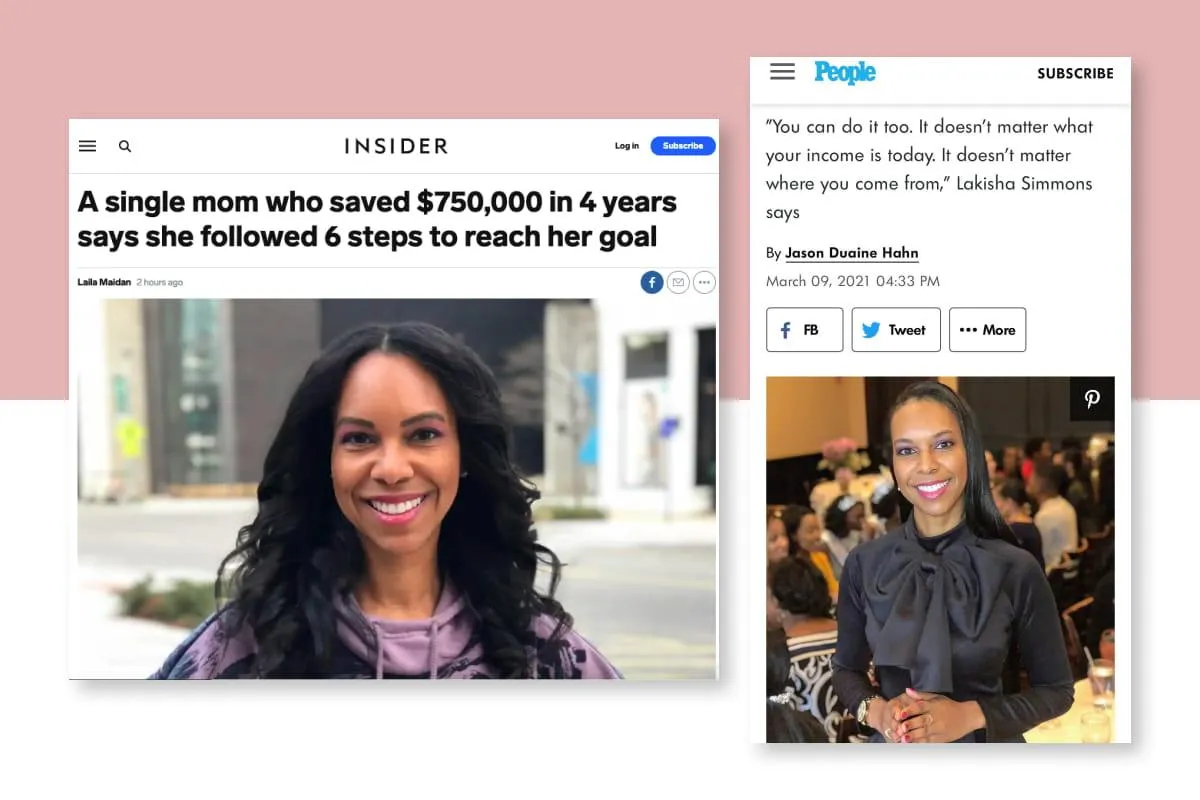

Dr. Lakisha Simmons

Financially Free at 41 years old after making an average of $77,000 a year.

WATCH THIS VIDEO FIRST

Start Investing

in Less Than 4 Weeks

If you're like me, you've been taught to go to college and make a better life for yourself right? Get a good job, buy a house, travel. But no one taught us what what to do with the money besides that. You go to work everyday and you have accumulated stuff but after a while you wonder what am I doing all of this for? What do I really have to show for all the years I've worked? What's next? Does this sound like you?

By the end of this financial freedom program, you will confidently know how to reduce your bills, payoff debt, and budget your money.

All while still enjoying life, take advantage of your retirement accounts, invest in the stock market and let your money make money.

You can do this if you are saving for a house, your kids college, or so you can retire before 65.

Learn my exact method that has helped men, women and families plan to become financially free in 10 years or less.

Join The Waiting List for The WealthyAchieveHer Financial Freedom Program and Receive for Free:

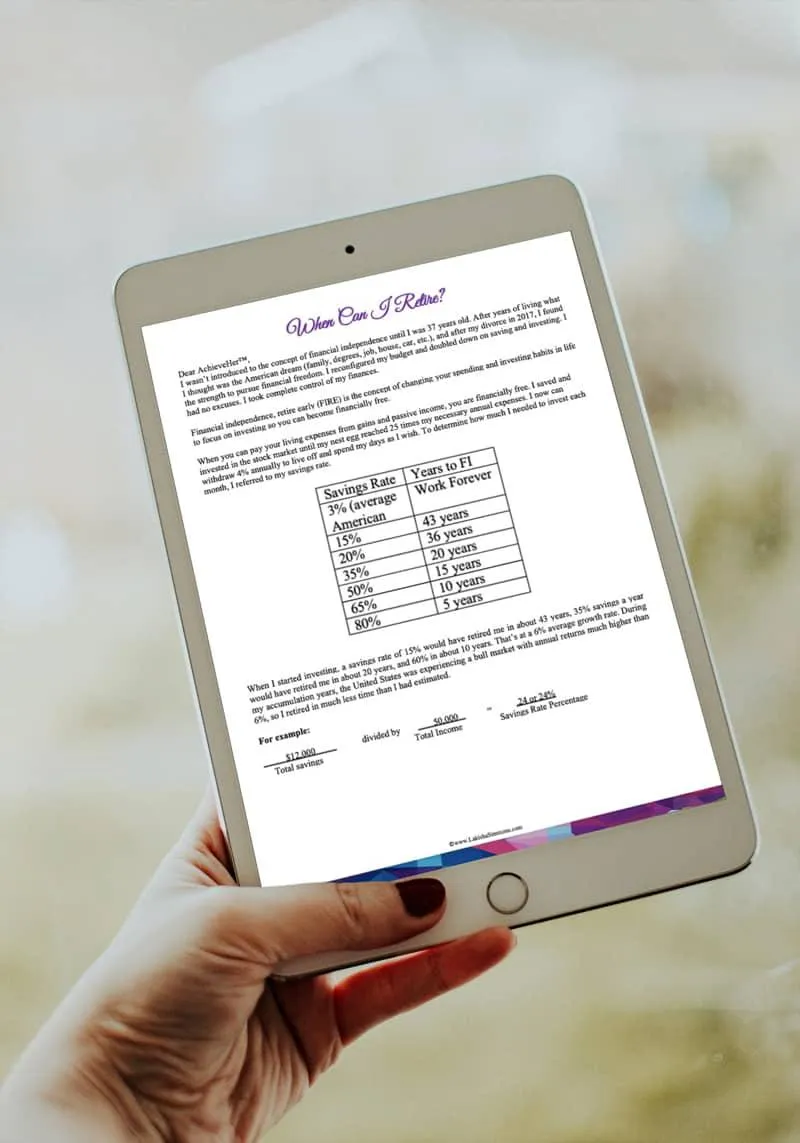

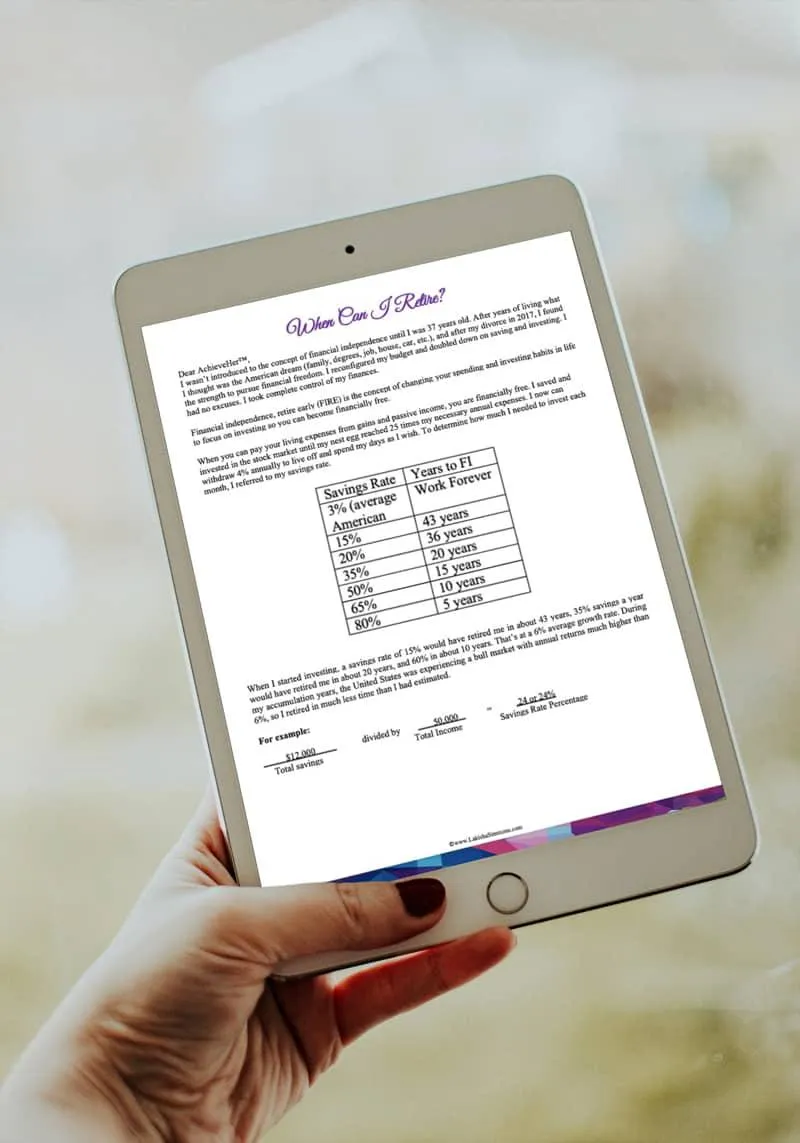

When Can I Retire?

Curious as to when you can financially call it quits at the pace you are on? Join the waiting list and I'll email you my Financial Freedom Calculator!

Join The Waiting List and Receive for Free:

When Can I Retire?

Curious as to when you can financially call it quits at the pace you are on? Join the waiting list and I'll email you my Financial Freedom Calculator!

Does this sound like you?

"I'm no longer interested in climbing the “corporate ladder.”

"I'm embarrassed about my financial situation."

"I' want to leave something for my kids."

I've been exactly where you are! I grew up poor and went through a devastating divorce in 2017. Worried about money all of the time. It's time to STOP the guilt, shame and excuses.

Does this sound like you?

- "I'm no longer interested in climbing the “corporate ladder.”

- "I'm embarrassed about my financial situation."

- "I' want to leave something for my kids."

I've been exactly where you are! I grew up poor and went through a devastating divorce in 2017. Worried about money all of the time. It's time to STOP the guilt, shame and excuses.

Imagine how it would feel to...

...have a $5,000+ emergency fund,

...have breathing room in your paycheck,

...have money flowing into your retirement accounts regularly,

...see your money compounding year after year,

... feel good about your personal finances,

...travel the world and experience different cultures,

....be financially free within 10 years!

This is financial freedom!

Imagine how it would feel to...

...have a $5,000+ emergency fund,

...have breathing room in your paycheck,

...have money flowing into your retirement accounts regularly,

...see your money compounding year after year.

... feel good about your personal finances.

...travel the world and experience different cultures.

....be financially free within 10 years!

This is financial freedom!

Hi, I'm Dr. Kisha.

In 2017 I was a single mom after a bitter divorce. Even though my average salary was $77k over my 19 year career, I was tired of not getting ahead. I needed my money to start working for me. I didn't want to work forever and was tired of being financially insecure. I had to learn to invest my money to take advantage of 7% average annual gains and compound interest.

I was new to investing, so I didn’t want to lose money or gamble, so I invested in the total stock market to diversify and lower my risk of loss. I started with my 401k to take advantage of tax breaks. I started side hustles to invest more. The stock market ride is bumpy day to day but overall it was up and I made a lot of money that I didn’t have to work for. Four years later I had accumulated $750k by sticking to a simple 3 step plan – reduce my expenses, maximize my 401k, and index fund investing.

Hi, I'm Dr. Kisha.

In 2017 I was a single mom after a bitter divorce. Even though my average salary was $77k over my 19 year career, I was tired of not getting ahead. I needed my money to start working for me. I didn't want to work forever and was tired of being financially insecure. I had to learn to invest my money to take advantage of 7% average annual gains and compound interest.

I was new to investing, so I didn’t want to lose money or gamble, so I invested in the total stock market to diversify and lower my risk of loss. I started with my 401k to take advantage of tax breaks. The stock market ride is bumpy day to day but overall it was up and I made a lot of money that I didn’t have to work for. Four years later I had accumulated $750k by sticking to a simple 3 step plan – reduce my expenses, maximize my 401k, and index fund investing.

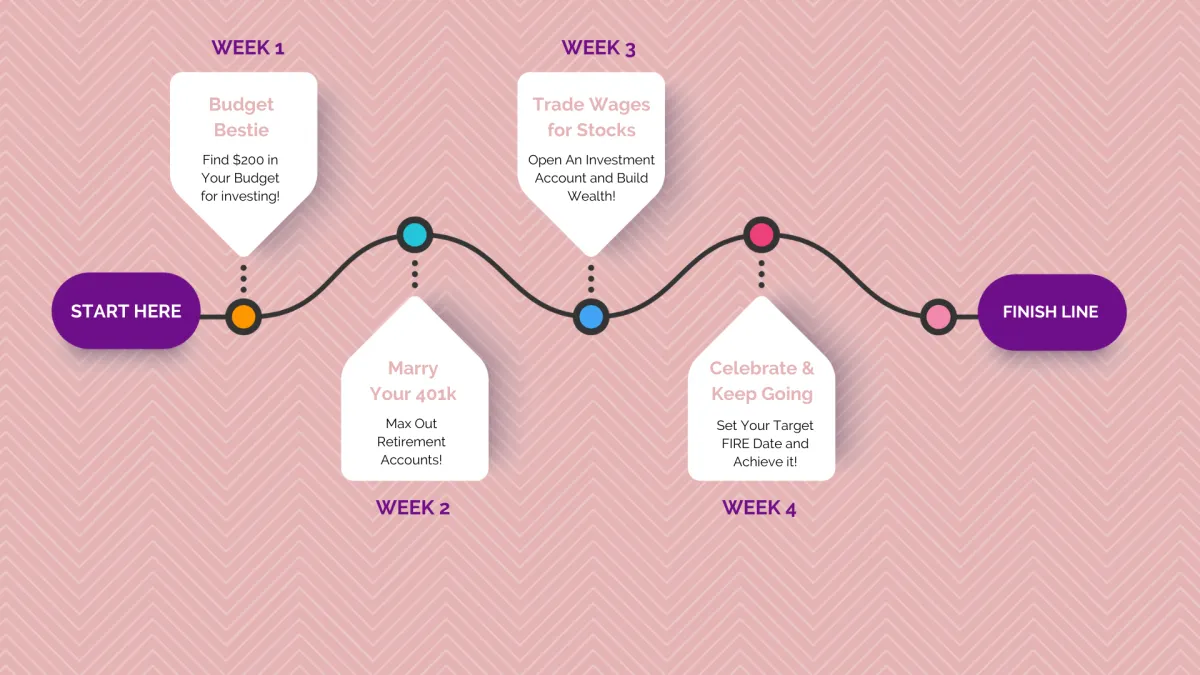

What You Will Be Learning for 4 Weeks

Each week you will watch a video and complete your personal financial assignments before we meet for a 60 minute live session over Zoom. Don't worry the lives are recorded and we will get a consensus on best time to meet.

Some of What You Will Learn

- Document your net worth as of today with included tools (you may be very surprised)

- Learn how to use my proprietary money system to plan and track spending on autopilot

- Learn over 10 easy ways to reduce your spending by 10% or more within 30 days

- Find your unique budgeting style and start using it effectively in the first week

- Open separate accounts for emergency fund and savings goals and immediately start saving for goals

- Easily pinpoint where you spend unnecessary money and cut it

- Calculate your specific emergency fund amount

- Plan your debt elimination and execute it while investing at the same time

- Set your savings, debt payoff and investment goals and project savings to meet those goals

- Learn about every major retirement account available and their similarities and differences (e.g. 403b, 457b, 401k, Traditional IRA, Roth IRA, TSP, and some you never heard of)!

- Use findings from Budget Bestie to determine exactly how much can you invest.

- Complete my proprietary retirement contributions planner to max out tax deferred accounts each year.

- Research and increase your specific workplace retirement contribution plans

- Business owners have amazing retirement plan options and they will be discussed in detail

- Understand the Roth IRA rules and how to you take contributions out without penalty. What is it, how is it different from other account types, what are the rules)

- How to access retirement funds legally before 65! (two ways)

- How to rollover old retirement accounts

- Read the stories of those living in early retirement (Black, White and Asian people who retired early)

- Calculate Your Financial Freedom Number so that you can FIRE (financial independence retire early) within 10 years.

- Learn exactly how pretax accounts save you money (pretax and HSA)

- Learn the order to invest in different account types for early retirement

- Understand how and why wages and dividends (from savings accounts) are taxed higher than capital gains

- Calculate your savings and investing rate so you can reach FIRE sooner

- Estimate your years necessary to achieve your FIRE number based on your savings rate

- Open and fund your investment account for FIRE

- Choose your investment options and allocation based on the Trinity Study (and updated study)

- Learn how to invest in the stock market and index fund fundamentals

- Open a Vanguard account and make a trade with me

- Create your investment plan

- Establish estate plan and assess insurance

- How to invest for your children's future through minor investment accounts

Budget Bestie

- Document your net worth as of today with included tools (you may be very surprised)

- Learn how to use my proprietary money system to plan and track spending on autopilot

- Learn over 10 easy ways to reduce your spending by 10% or more within 30 days

- Find your unique budgeting style and start using it effectively in the first week

- Open separate accounts for emergency fund and savings goals and immediately start saving for goals

- Easily pinpoint where you spend unnecessary money and cut it

- Calculate your specific emergency fund amount

- Plan your debt elimination and execute it while investing at the same time

- Set your savings, debt payoff and investment goals and project savings to meet those goals

Marry Your 401k

- Learn about every major retirement account available and their similarities and differences (e.g. 403b, 457b, 401k, Traditional IRA, Roth IRA, TSP, and some you never heard of)!

- Use findings from Budget Bestie to determine exactly how much can you invest.

- Complete my proprietary retirement contributions planner to max out tax deferred accounts each year.

- Research and increase your specific workplace retirement contribution plans

- Business owners have amazing retirement plan options and they will be discussed in detail

- Understand the Roth IRA rules and how to you take contributions out without penalty. What is it, how is it different from other account types, what are the rules)

- How to access retirement funds legally before 65! (two ways)

- How to rollover old retirement accounts

- Read the stories of those living in early retirement (Black, White and Asian people who retired early)

Trade Stocks and Retire Early

- Calculate Your Financial Freedom Number so that you can FIRE (financial independence retire early) within 10 years.

- Learn exactly how pretax accounts save you money (pretax and HSA)

- Learn the order to invest in different account types for early retirement

- Understand how and why wages and dividends (from savings accounts) are taxed higher than capital gains

- Calculate your savings and investing rate so you can reach FIRE sooner

- Estimate your years necessary to achieve your FIRE number based on your savings rate

- Open and fund your investment account for FIRE

- Choose your investment options and allocation based on the Trinity Study (and updated study)

- Learn how to invest in the stock market and index fund fundamentals

- Open a Vanguard account and make a trade with me

- Create your investment plan

- Establish estate plan and assess insurance

- How to invest for your children's future through minor investment accounts

Prosperity Goals Setting and Financial Freedom Plan Feedback*

*Exclusive to The Wealthy AchieveHer Financial Freedom Program

- Finalize and get feedback on your complete financial freedom plan

- How to harness the power of compound interest to refine your FIRE strategy

- Participate in Dr. Kisha's proprietary Prosperity Goals setting workshop and revise your money goals (90days, 1year and other)

- Learn how to boost your mindset to spend less and invest more.

- Update your net worth calculation and reveal your progress in the last 30 days.

- 4 Group Coaching Calls with Dr. Kisha, retired at 41, personal finance expert and PhD in analytics.

Budget Bestie

- Document net worth as of today

- How to use the money planner

- Monthly Expense Tracking: Reduce your spending by 10%

- Find your budgeting style and start using it

- Open separate accounts for emergency fund and savings goals. Start saving for goals

- Challenge: Spending tracker for 10 days

- Pinpoint where you spend unnecessary money

- Calculate your emergency fund needs

- Plan your debt elimination

- Set Money Goals and project savings

Some of What You Will Learn

Budget Bestie

- Document net worth as of today

- How to use the money planner

- Monthly Expense Tracking: Reduce your spending by 10%

- Find your budgeting style and start using it

- Open separate accounts for emergency fund and savings goals. Start saving for goals

- Challenge: Spending tracker for 10 days

- Pinpoint where you spend unnecessary money

- Calculate your emergency fund needs

- Plan your debt elimination

Week 2

Marry Your 401k

- Learn about every major retirement account and some you never heard of!

- Use findings from Budget Bestie to determine exactly how much can you invest.

- Complete my proprietary retirement contributions planner to max out tax deferred accounts each year.

- Research and increase your specific workplace retirement contribution plans

- Business owners have amazing retirement plan options and they will be discussed in detail

- Understand the Roth IRA rules and how to you take contributions out without penalty (What is it, how is it different from other account types, what are the rules)

- How to access retirement funds legally before 65! (two ways)

- How to rollover old retirement accounts

Week 3

Trade Stocks and Retire Early

- Calculate Your Financial Freedom Number so that you can FIRE (financial independence retire early) within 10 years.

- Learn exactly how pretax accounts save you money (pretax and HSA)

- Understand how and why wages and dividends (from savings accounts) are taxed higher than capital gains

- Calculate your savings and investing rate so you can reach FIRE sooner

- Estimate your years necessary to achieve your FIRE number based on savings rate

- Open and fund your investment account for FIRE

- Choose your investment options and allocation based on Trinity Study

- Learn how to invest in the stock market and index fund fundamentals

- Open and Fund your Brokerage Account for FIRE

- Choose your investment options and allocation

- Open a Vanguard account and make a trade with me

- Establish estate plan and assess insurance

Week 4

Celebrate & Keep Going*

*Exclusive to The Wealthy AchieveHer Financial Freedom Program

- Finalize and get feedback on your complete financial freedom plan

- How to harness the power of compound interest to refine your FIRE strategy

- Participate in Dr. Kisha's proprietary Prosperity Goals setting workshop and revise your money goals (90days, 1year and other)

- Learn how to boost your mindset to spend less and invest more.

- Update your net worth calculation and reveal your progress in the last 30 days.

- 4 Group Coaching Calls with Dr. Kisha, retired at 41, personal finance expert and PhD in analytics.

See What My Students Have To Say

Jarlecia J..

The biggest financial education takeaway I learned from the workshop is it is doable to retire early and FIRE. My savings and investing rate jumped from 8% at the beginning of the course to 18% by the end of the four weeks. Dr. Kisha's workshop was the reality call I needed!

I never attended a workshop that shared a whole picture or step by step on how to accomplish the ultimate financial goal, retiring early.

The Wealthy Achiever program provides a methodical approach to discuss the importance of monthly budgeting to be intentional with spending to understand the complexities of IRA, Roth IRA, Brokerages, and etc. The workbook and spreadsheets provided helps keep track of debt decreasing and income/investments increasing to visually see the progress made. The overall support of Dr. Kisha and the other participants have given me the encouragement to stay on this journey of financial freedom!

Danielle L.

I valued the detailed recorded videos and workbook a great deal. I can reference them at any time! I now have a much better understanding of my 401k/Roth, tax deferred accounts and the importance/advantages of maxing out each. I plan to FIRE in 7-10 years! Dr. K's enthusiasm was the best part. I doubt that others are sharing this type of information in this much detail. I also like that Dr. K shared openly. If she was unsure of something she would check her resources. I plan to stay connected to her and I will share her program with other women. Let's Gooo, Let's plan to Fire!

Markeyta W.

"I cut my expenses down by nearly $300/month so far and now I'm investing it. Dr. Kisha definitely helped me to shift my mindset from saving to active investor!"

Heather N.

"Your Trade Stocks class and this mini movement that you've started have completely shifted the way I think about what matters and how to make the most of living."

Tonya S., Consultant

"The Budget workshop is the best workshop that I have attended and it is so worth the cost. Dr. Kisha provided so many pieces of valuable information and resources. I started right after the workshop looking at ways to cut expenses. I see me saving at least $200 a month. You don't have to setup anything unlike other workshops. The budget Google sheet is so simple to use."

David A. Weil II, J.D., M.B.A.

"I virtually attended Lakisha L. Simmons, Ph.D.'s Budget Bestie Workshop as part of her Unlikely AchieveHer Program. She cheerfully and enthusiastically furnished practical, easy-to-understand advice and simple, easy-to-use templates to empower us to competently manage our personal budgets, gain a clear line of sight as to our expenses and favorably change our behavior to spend less and save more. It is an exceptional and highly important learning experience that I highly recommend to everybody."

See What My Students Have To Say

The biggest financial education takeaway I learned from the workshop is it is doable to retire early and FIRE. It is extremely important to have a strategic plan and attend Dr. Kisha's workshop to learn the various ways to invest and understand the proper way to start the process to maximize investments that are tax advantageous while planning for retirement early.

My savings and investing rate jumped from 8% at the beginning of the course to 18% by the end of the four weeks. Dr. Kisha's workshop was the reality call I needed! I never attended a workshop that shared a whole picture or step by step on how to accomplish the ultimate financial goal, retiring early.

The workbook and spreadsheets provided helps keep track of debt decreasing and income/investments increasing to visually see the progress made. The overall support of Dr. Kisha and the other participants have given me the encouragement to stay on this journey of financial freedom!

Jarlecia J.

I enjoyed the recorded videos. It was nice to watch them at my own pace and go back and rewatch a topic that may have not been completely clear. I also enjoyed the open discussion live calls.

I'm in my mid 30's and plan to be financially independent in less than 15 years and I'm just starting! This program is a MUST!! I highly recommend it to adults of all ages. Dr. Kisha easily breaks down financial planning that can meet anyone's current financial status. Thank you Dr. Kisha! I will review the materials and videos in the course for years to come.

Jamie C.

I valued the detailed recorded videos and workbook a great deal. I can reference them at any time! I now have a much better understanding of my 401k/Roth, tax deferred accounts and the importance/advantages of maxing out each. I plan to FIRE in 7-10 years! Let's Gooo, Let's plan to Fire!

Danielle L.

"I cut my expenses down by nearly $300/month so far and now I'm investing it. Dr. Kisha definitely helped me to shift my mindset from saving to active investor!"

Markeyta W.

"Your Trade Stocks class and this mini movement that you've started have completely shifted the way I think about what matters and how to make the most of living."

Heather N.

"I virtually attended Lakisha L. Simmons, Ph.D.'s Budget Beastie Workshop as part of her Unlikely AchieveHer Program on February 11, 2021. She cheerfully and enthusiastically furnished practical, easy-to-understand advice and simple, easy-to-use templates to empower us to competently manage our personal budgets, gain a clear line of sight as to our expenses and favorably change our behavior to spend less and save more. It is an exceptional and highly important learning experience that I highly recommend to everybody."

David A. Weil II, J.D., M.B.A.

Here's What You'll Get:

Don't worry, there are no confusing terminology or boring math lectures. This is investing made simple!

Easy to Use Guides

- Weekly recorded 90-minute hands-on workshops with Dr. Kisha ($250 value each) to watch to learn the core materials.

- Downloadable and printable worksheets and text learning materials to complete your investing plan. ($59)

- Weekly challenges ($47 value)

Digital Assets and Software

- 9 Financial planning sheets ($47 value)

- 5 sheet Google Sheets Automated Budget that Dr. Kisha uses to manage her money. ($27)

- Workbook to complete as you work through the course.

- FIRE plan template.

More Testimonials

More Testimonials

Jamie C.

I enjoyed the recorded videos. It was nice to watch them at my own pace and go back and rewatch a topic that may have not been completely clear. I also enjoyed the open discussion live calls.

I learned exactly what my FIRE number is and how long it will hopefully take me to reach that number. I also learned more about the different types of investment accounts and how much I can contribute to each of them. I'm in my mid 30's and plan to be financially independent in less than 15 years and I'm just starting! This program is a MUST!! I highly recommend it to adults of all ages. Dr. Kisha easily breaks down financial planning that can meet anyone's current financial status. Thank you Dr. Kisha! I will review the materials and videos in the course for years to come.

Learn at your own pace with the

SELF-PACED COMPLETE FINANCIAL FREEDOM PROGRAM

Self-Paced Program

The Complete Financial Freedom Program is a self-paced course. It includes hours of recorded lectures, Facebook group access, and my proprietary financial independence textbook. By the end of the lessons, you will be able to double or triple your savings rate and finally start investing.

This more affordable option gives you get lifetime access to all the 30+ lessons! Group coaching with Dr. Kisha and groupme access are not available with this option.

Self Paced Course is a $3,000 Value!

$497 New Year Sale!

Countdown

WEEK 1

Find $200 in Your Budget for investing!

Cut spending by at least 10% with these money saving strategies. Perfect for those just getting serious about their finances. Stop dreaming about being debt free and start taking the right steps to reach your financial goals. Included are multiple paper-based worksheets, calculators and additional planning materials.

WEEK 2

Max Out Retirement Accounts!

Maximize retirement accounts like the 401k, 457b and Roth IRA. Create your customized retirement planner. You'll learn everything you need to know about retirement accounts to retire in half the time and how to access the money before 65 without penalty so you can retire early! Stop missing out on wealth and start taking the right steps to reach your retirement goals.

WEEK 3

Open An Investment Account and Build Wealth!

Learn exactly how the stock market works and how to trade! Calculate your specific financial independence number, how much you should invest in stocks to get there, which type of stocks and how long it will take. Then we talk about index fund investing and walk through a trade together. You’re going to grow your money by way more than the cost of the course.

WEEK 4

Set Your Target FIRE Date and Achieve it!

Learn to increase your investments over time to hit your FIRE Number in record time. We will use my proprietary goals planner to map out short and long term goals to ensure you stay on track to build the wealth you deserve. Each week has a group coaching call and this week we will celebrate success! You're never alone on this journey. Stay in touch in our private Facebook group and continue to receive high touch support!

"The Budget workshop is the best workshop that I have attended and it is so worth the cost. Dr. Kisha provided so many pieces of valuable information and resources. I started right after the workshop looking at ways to cut expenses. I see me saving at least $200 a month. You don't have to setup anything unlike other workshops. The budget Google sheet is so simple to use."

Tonya S., Consultant

Learn at your own pace with the

Complete Financial Freedom Program

The Complete Financial Freedom Program is a self-paced course. It includes hours of recorded lectures, Facebook group access, and my proprietary financial independence textbook. You can start anytime and you get lifetime access to all the 30+ lessons. There is no group coaching with Dr. Kisha or groupme app access with this option.

WEEK 1

Find $200 in Your Budget for investing!

Cut spending by at least 10% with these money saving strategies. Perfect for those just getting serious about their finances. Stop dreaming about being debt free and start taking the right steps to reach your financial goals. Included are multiple paper-based worksheets, calculators and additional planning materials.

WEEK 2

Max Out Retirement Accounts!

Maximize retirement accounts like the 401k, 457b and Roth IRA. Create your customized retirement planner. You'll learn everything you need to know about retirement accounts to retire in half the time and how to access the money before 65 without penalty so you can retire early! Stop missing out on wealth and start taking the right steps to reach your retirement goals.

WEEK 3

Open An Investment Account and Build Wealth!

Learn exactly how the stock market works and how to trade! Calculate your specific financial independence number, how much you should invest in stocks to get there, which type of stocks and how long it will take. Then we talk about index fund investing and walk through a trade together. You’re going to grow your money by way more than the cost of the course.

WEEK 4

Set Your Target FIRE Date and Achieve it!

Learn to increase your investments over time to hit your FIRE Number in record time. We will use my proprietary goals planner to map out short and long term goals to ensure you stay on track to build the wealth you deserve. Each week has a group coaching call and this week we will celebrate success! You're never alone on this journey. Stay in touch in our private Facebook group and continue to receive high touch support!

Complete Financial Freedom Program (Self-Paced)

EASY TO USE GUIDES

DIGITAL ASSETS & SOFTWARE

CORE LESSONS ($2,500 value)

- Budget Bestie Method

- Marry Your 401k

- Trade Stocks and Retire Early

- Over 30 training lessons in three modules!

- Private Facebook Group ($150 value)

$3,000 Value!

$597 special price

$397

(ends soon)

Join hundreds of amazing women who are building generational wealth!

Frequently Asked Questions

1. Is this worth the money?

We definitely believe you will save as much as the cost of the course if you make even a few of the many budget cuts suggested in Part 1 - Budget Bestie (for example switching to Mint Mobile or using Fetch). Once you begin maximizing your tax deferred retirement accounts you will save money on taxes (I explain how in detail in Marry Your 401K). So, YES, it's worth the investment to learn what you don't know from someone who has done it.

The Group Coaching program has weekly access to Dr. Kisha's wisdom and presence through our virtual meetings. We meet virtually for four Thursday evenings 6:00pm CST - 7:00pm CST. We believe you will the information is worth more than the cost of admission.

2. How long before I make money trading?

There are no guarantees in the stock market. Past performance doesn't predict the future. Dr. Kisha uses a buy and hold strategy as a long term investor. Your strategy may be different, but either way you can make money and lose money. This course teaches you the FIRE strategy of index fund investing for the best diversification strategy to ride out the choppy stock market. It's how Dr. Kisha accumulated her wealth as featured in Black Enterprise.

3. How do I know if it will work for me?

Cutting expenses, investing in your 401k and investing in the stock market are no brainers! The problem is that many people just don't know what they don't know. That is likely where you are. I'll explain things you never knew were even an option for you. For example, teachers, law enforcement, doctors and other service occupations have access to 457b accounts which are deferred compensation. These tax-deferred accounts are accessible to tap anytime. Let me show you how to build wealth, step by step!

4. How long does it take to complete the course?

The Group Coaching program lasts four weeks. However, you have lifetime access to enjoy hours of quality video recorded content to walk you through how to create your financial freedom plan. Not to mention a complete introduction to the stock market! The videos were recorded with a class so you also get the benefit of hearing the questions and answers of others who are in the course!

5. When does the class begin?

The next group cohort of students will begin the program on May 1, 2022. The group coaching will end on May 31, 2022 but your access to the materials is ongoing. Join us before registration ends and the doors close!

6. Is anyone in the group expected to disclose any of their personal financial information to the group?

This is a safe space to share. However, there is no expectation that you share any personal information at all. It's unnecessary to share any personal information to the group or the facilitator. But feel free to ask questions about your situation keeping in mind this is not financial advice, only education.

7. What is the duration of the live virtual meeting? When are the meetings?

The 60 minute weekly virtual meeting will be during the weekdays in the evenings. We meet virtually Thursday evenings 6:00pm CST - 7:00pm CST. However, the weekly meeting will be recorded so that those who can not make the meeting can stay on track.

8. The rest of the content is mostly videos and worksheets that we would do on our own, correct?

The program consists of the following expectations each week: watch a prerecorded workshop video before we meet (approximately 90 minutes), complete financial worksheets from the workbook, and one weekly group coaching call (60 minutes).

Frequently Asked Questions

We definitely believe you will save as much as the cost of the course if you make even a few of the many budget cuts suggested in Part 1 - Budget Bestie (for example switching to Mint Mobile or using Fetch). Once you begin maximizing your tax deferred retirement accounts you will save money on taxes (I explain how in detail in Marry Your 401K). So, YES, it's worth the investment to learn what you don't know from someone who has done it.

The Group Coaching program has weekly access to Dr. Kisha's wisdom and presence through our virtual meetings. We meet virtually for four Thursday evenings 6:00pm CST - 7:00pm CST. We believe you will the information is worth more than the cost of admission.

There are no guarantees in the stock market. Past performance doesn't predict the future. Dr. Kisha uses a buy and hold strategy as a long term investor. Your strategy may be different, but either way you can make money and lose money. This course teaches you the FIRE strategy of index fund investing for the best diversification strategy to ride out the choppy stock market. It's how Dr. Kisha accumulated her wealth as featured in Black Enterprise.

Cutting expenses, investing in your 401k and investing in the stock market are no brainers! The problem is that many people just don't know what they don't know. That is likely where you are. I'll explain things you never knew were even an option for you. For example, teachers, law enforcement, doctors and other service occupations have access to 457b accounts which are deferred compensation. These tax-deferred accounts are accessible to tap anytime. Let me show you how to build wealth, step by step!

The Group Coaching program lasts four weeks. However, you have lifetime access to enjoy hours of quality video recorded content to walk you through how to create your financial freedom plan. Not to mention a complete introduction to the stock market! The videos were recorded with a class so you also get the benefit of hearing the questions and answers of others who are in the course!

The next group cohort of students may begin the program a few months from now. But your access to the materials is ongoing in the self paced option. Join us before registration ends and the doors close!

This is a safe space to share. However, there is no expectation that you share any personal information at all. It's unnecessary to share any personal information to the group or the facilitator. But feel free to ask questions about your situation keeping in mind this is not financial advice, only education.

The 60 minute weekly virtual meeting will be during the weekdays in the evenings when there is a 4 Week Group coaching program. We meet virtually Thursday evenings 6:00pm CST - 7:00pm CST. However, the weekly meeting will be recorded so that those who can not make the meeting can stay on track (only for those enrolled in the Group Coaching program, not the self-paced option).

The TWA 4 week Group Coaching program consists of the following expectations each week: watch a prerecorded workshop video before we meet (approximately 90 minutes), complete financial worksheets from the workbook, and one weekly group coaching call (60 minutes).

Are you ready to have financial freedom?

Copyright @2022 www.LakishaSimmons.com